❝Working as a freelancer in portugal and taking advantage of the NHR tax scheme.❞

An increasing number of professionals is choosing Portugal to work as a freelancer and look at the NHR program and the special tax rates available as a great opportunity.

At All Finance Matters we have an experienced team of accountants and tax advisors, that can look after you and make sure that you and your business are fully compliant with the tax laws and take the most advantage of the NHR status.

Our team is fluent in English and or French and will guide you through all the steps of the registration of your business here.

Different ways of continuing your business activity while NHR in Portugal

There are different scenarios when deciding to continue with your business activity in Portugal and take advantage of the NHR status.

Become self-employed in Portugal

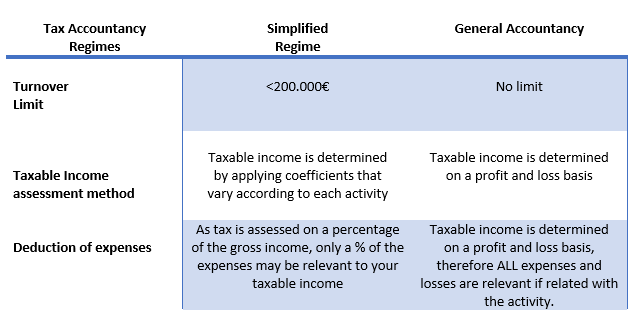

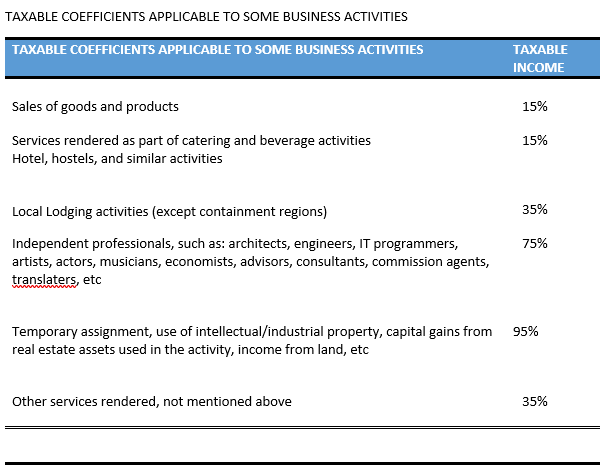

In this case providing you have an eligible occupation your tax liability will be in most cases 20% of 75% of your gross income (simplified regime), or 20% of your profit (normal organized accountancy regime).

The 75% is the coefficient applied by the tax authorities to your activity, it means that your profit is automatically 75% of your income. If however you feel that your costs are higher than 25%, you can choose to be on normal accountancy, rather than simplified and pay the 20% on your profit.

In the first 12 months of activity your will be exempt for Social Security payments, but after these you will be liable. The Social Security averages 15% of your gross income and is calculated every quarter. In case you have no income in a quarter, the monthly payments for the following quarter are 20€ (the minimum). The SS payments are reassessed again in the following quarter.

Set up a company in Portugal

One of the options is to create a company, which is eligible to be on the fiscal transparency, and which activity is one of the listed as per the NHR rules. In this case, you will be taxed at 20% and not the company.

There will be no tax on the dividends because the fiscal transparency implies that the profit of the company is taxed in the personal sphere and this means that as the profit is already taxed it can be transferred to the shareholder without any further taxation.

For the company to be eligible for the fiscal transparency, it is necessary that the company provides a professional activity (consultancy for instance) and the shareholders/directors that provide the service own at least 75% of the share capital.

If you are the only shareholder and director, this works, but you can have partners in the business, providing the partners that offer the service own at least 75% of the busines.

Requirements to set up a limited company in Portugal

To set up a Private Limited Company (Sociedade por Quotas also known as Lda) it’s needed to have a minimum of one partner and minimum capital investment of 1 EUR.

Shareholders are jointly responsible for everything agreed in the Articles of Association.

Shareholders are liable for debts up to the amounts covered by business assets.

Directors are liable for tax and social security debts and debts to employees.

Name

Please send us 3 names, so we can see if they are viable.

We will let you know if we think it’s viable, prior to asking for the admissibility certificate.

If you wish to use your personal name XXXXXX & XXXXXXX LDA, this would also be acceptable. Alternatively, you can choose a pre-approved name from the list on the link: http://bolsafirmasdenominacoes.justica.gov.pt/index.php?app=enh

Head Office

Choose your own address as the head office or use our office address.

Please note that to change this in the future there will be notary and registration costs, this will also be the case to make any other changes to the statutes of the company.

Share Capital

Although the minimum is 1€, the company will need some money to the initial investments, including the notary and registration fees, etc. We recommend a minimum of 1.000€

Shareholders

We need to know who the shareholders and the share structure.

Directors

The company needs to appoint at least one director. In case the director is not employed in Portugal or does not have any social security contributions in the EU, it will be obliged to have a salary or pay social contributions in Portugal. This means that the yearly social security payments will be:

– circa 3.430€ for each director if they have a company salary; or

– circa 1.850€ for each director, if in this case the director does not have a salary and prefer to just pay the minimum contribution.

Decision Making

One director is enough to represent the company. In case you have more than one director, you need to specify if it’s necessary the signature of both or if the company can be represented with the signature of just one.

Activities

Please include all activities that you think you may want to do in the future, even if at the beginning the company will not exercise it (to avoid changing the statutes of the company because of this in the future).

Frequently asked questions about doing business in Portugal:

When should I registering my activity at the tax office and Social Security?

All sole traders must register their activity at the tax office and Social Security, prior to the start of the activity.

What is required to make the registration?

You will need to have a NIF and a Portuguese bank account to register your activity. You will also be required to choose the activity code, the VAT regime, and the tax regime that you will opt for (organized accountancy or simplified regime).

Can I have more than one activity?

Yes, you can choose more than one activity code.

Is there a threshold for my income before I start paying tax?

No, the threshold is only available for VAT.

What is the threshold for VAT?

If your yearly turnover is under 12.500€, you will be VAT exempt. However if you supply services or goods to countries outside Portugal, you must be liable for VAT.

Does it mean I pay VAT on my services to my clients outside Portugal?

No, providing your client is a VAT registered entity, your invoice will be without VAT, but you are still required to file quarterly VAT returns.

What is my VAT number?

If you are a freelancer, you and your business are the same entity, so your VAT number is your NIF (in some cases you can add PT before your NIF for international identification).

When do I start paying Social Security?

If this is your first activity registration in Portugal, it means that you will benefit from a 12 month social security exemption. After this your social security will be assessed quarterly, based on your income (simplified regime) or on you profit (normal regime) from the previous quarter and you may pay 15% of your gross income each month as a social security contribution.

ACCOUNTANCY REGIMES FOR SOLE TRADERS

List of eligible occupations effective as of 01-01-2020

I – Professional activities (PCP codes):

112 – General director and executive manager of a company;

12 – Directors of administrative and commercial services;

13 – Directors of production and specialized services;

14 – Directors of hotel, restaurant, commercial and other services;

21 – Specialists working in physical sciences, mathematics, engineering and similar technical fields;

221 – Physicians;

2261 – Dentists and stomatologists;

231 – Teachers at universities and higher learning establishments;

25 – Specialists in information and communication technologies (ICT);

264 – Authors, journalists and linguists;

265 – Creative artists and performing artists;

31 – Intermediate level science and engineering technicians and professionals;

35 – Information and communication technologies technicians;

61 – Market oriented farmers and qualified agricultural and livestock workers;

62 – Market oriented qualified forestry, fisheries and hunting workers;

7 – Qualified industrial, construction workers and craftsmen, including qualified workers in the fields of metallurgy, metalworking, food processing, wood manufacturing, clothing production, handicrafts, printing, manufacture of precision instruments, jewellers, artisans, electricity and electronics workers;

8 – Operators of installations and machines and assembly workers, namely fixed installations and machine operators.

The workers included in the above-mentioned professional activities shall possess at least a level 4 qualification on the European Qualifications Framework or a level 35 on the International Standard Classification of Education, or they must have five years of duly proven professional experience.